Introduction

There’s no doubt that the remarkable adventures of Jho Low will earn him a spot in literary history alongside Ulysses. However, only a fool would believe that the cyclops and sirens from the “Odyssey” are real creatures or that there is no more to Jho Low’s story than only what we’ve been told.

The mainstream media has presented us with a remarkable manufactured cover story.

“A 28-year-old Malaysian businessman of Chinese descent, whose grandfather amassed wealth through liquor distilleries and real estate in Thailand and Hong Kong in the 1960s and 1970s, orchestrated one of the largest frauds in history, diverting $4.5 to $7 billion from the Malaysian Sovereign Wealth Fund into his personal accounts. Over 4 years, this “Mastermind” managed to deceive half of the planet and funneled some of this money to his co-conspirators in various business ventures around the world, including the son of the King of Saudi Arabia, the brother of the President of the UAE, the son of the Prime Minister of Kuwait, and the step-son of the President of Malaysia. For the past 7 years, this fugitive has been hiding somewhere in China, apparently under the protection of the Chinese government. If that was not enough, he managed to do something no other criminal had achieved before; he signed a deal in absentia with the US Department of Justice, which would allow him to remain free by returning only a fraction of the money that disappeared without accepting any guilt in the scandal.”

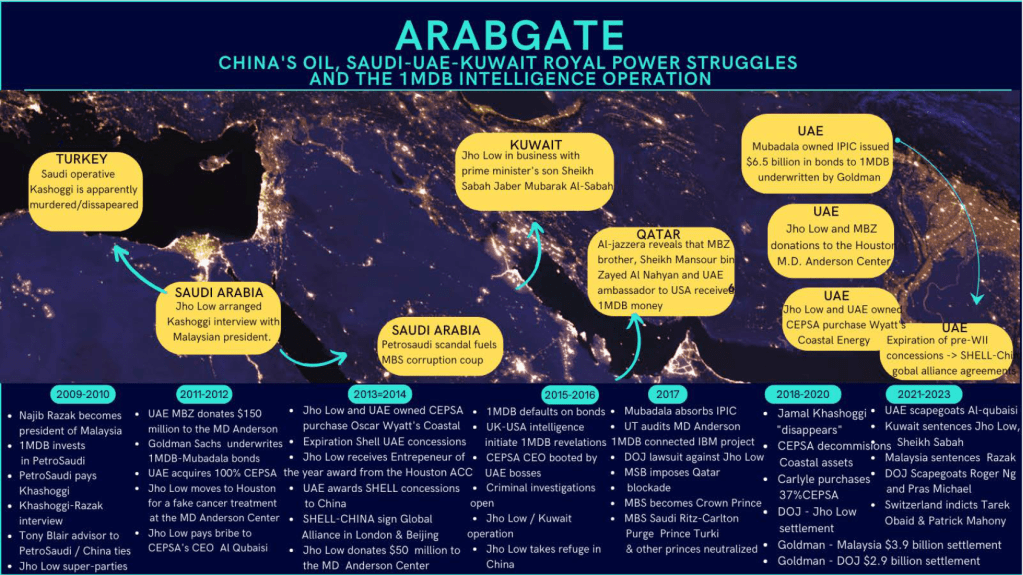

In 2018, Goldman Sachs agreed to pay $6.8 billion in two almost consecutive settlements due to its involvement in issuing fraudulent bonds linked to the 1MDB scandal. This included a $3.9 billion settlement with the Department of Justice (DOJ) and a separate $2.9 billion settlement with the government of Malaysia [1]. This remains the largest fine ever paid by the investment bank in its 150-year history [2]. The U.S. DOJ’s Attorney General and the FBI’s Deputy Director described the 1MDB scandal as the most significant case of kleptocracy in history [3]. Currently, there are ongoing cases in five different jurisdictions related to various aspects of the 1MDB scandal: Switzerland [4], Malaysia [5], the USA [6], Singapore [7], and the UK [2].

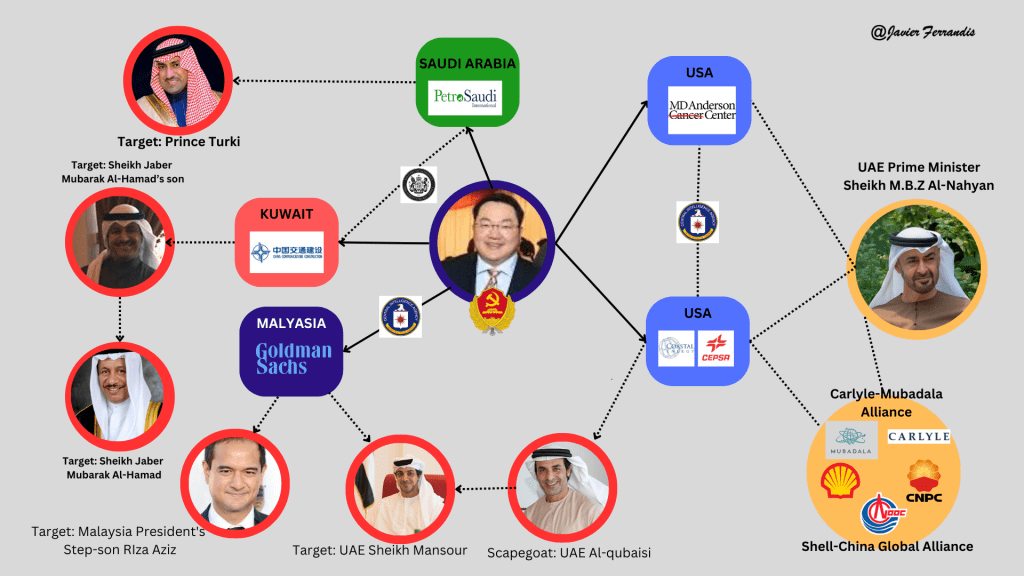

The distance from the events— which occurred between 2010 and 2016—provides a broader perspective, illuminating the 1MDB scandal as more than just a simple case of kleptocracy. In several previous articles [8-11], this author has pointed out that the 1MDB scandal is not a real kleptocracy case but a sophisticated intelligence operation, the fruit of the collaboration mainly of the intelligence services of the USA, China, and the UK but also of other players such as the intelligence services of the UAE, Saudi Arabia, Malaysia, Spain, Turkey, and Thailand [8]. From an economic point of view, the primary goal of the operation was the transfer of very sizable long-term Oil & Gas concessions in the United Arab Emirates from major Western corporations, Shell and Exxon, to the two largest Chinese NOCs: CNOOC, and CNPC [8]. Immediately after CNOOC, and CNPC signed two strategic alliance agreements with Shell Oil in Beijing, and London. This fits within a longer ongoing process, which is the incorporation of China into an “extended” US-led petrodollar system.

Keeping this in mind, from the economic side, the so-called scandal is a convoluted but obvious financial engineering operation geared towards delivering a huge commission, a bribe, to the Emirati royal family and associates that agreed to and facilitated the operation. The Purchase of Oscar Wyatt’s Coastal by Emirati-owned CEPSA allowed the transfer of wealth through the manipulation of the value of Coastal and the later overvalued purchase of part of CEPSA by the Carlyle Group [9-10]. The CEPSA-Coastal purchase was also a means to pay the Chinese government avatar, i.e., Jho Low, and the many US-based collaborators that participated in the operation. This author has also explained that the M.D. Anderson Cancer Center collaboration provided a cover for the presence of Jho Low in Houston [11], allowed the payment of a kickback to PwC for the design of the financial structure of the operation, and allowed the channeling of funds to IBM for the development of concealed social media communication tools still in use today by all the participants in the operation [11].

This article will explain some of the specific political objectives related to the 1MDB “scandal.” Decades ago, it was understood that creating a US-led extended petrodollar system that included China would necessitate a significant transformation of the Middle East. It was anticipated that this would involve transferring large oil and gas concessions in the Arabian Peninsula to Chinese National Oil Companies (NOCs). Additionally, it was expected that increased reliance on Arabian oil and gas would lead to polarization and direct confrontation with Iran, particularly because Iranian and Iraqi oil output would need to be suppressed for the extended petrodollar system to function effectively.

This would require that individuals in powerful positions within the various Saudi royal families are fully aligned with this agenda. Therefore, it was necessary to neutralize those branches within the Arabian royal houses who were viewed as less cooperative, while supporting those deemed more friendly and receptive to the numerous changes transforming the region. These two articles will examine how the different phases of the 1MDB Operation were designed to damage the reputations of their targets and undermine them politically.

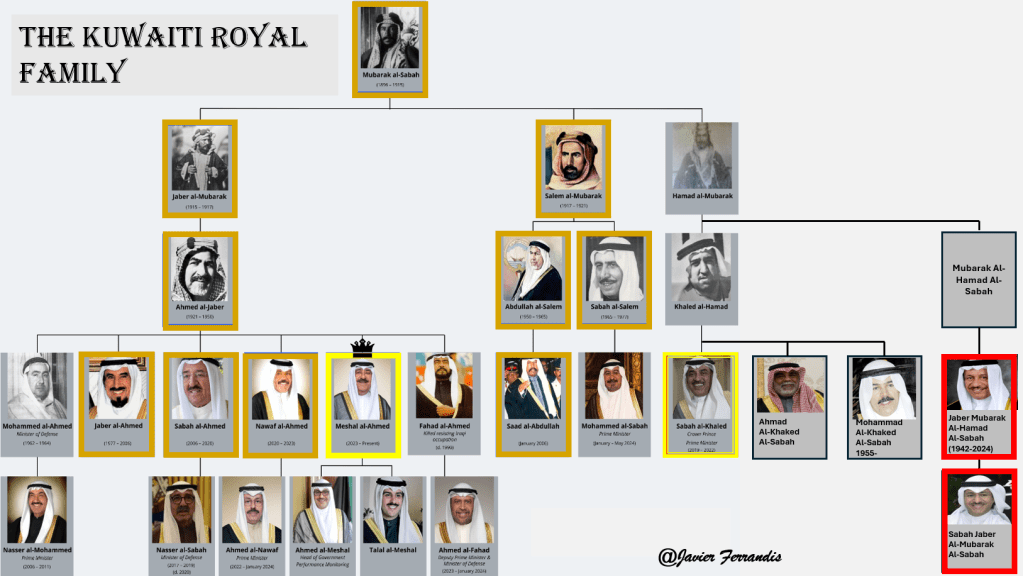

The Kuwait Phase

Since the death of Kuwait’s first emir, Mubarak Al-Sabah, in 1915, the country has been ruled by emirs who are descendants of two of his sons: Jaber Al-Mubarak and Salem Al-Mubarak. Although all branches of the family must agree on the election of a new emir, the descendants of Mubarak’s third son, Hamad Al-Mubarak, have not produced any emir since the establishment of modern Kuwait. The Al-Hamad branch and the Al-Jarrah branch (not included in this discussion) have produced sheiks who have held significant government positions, such as Prime Ministers and Ministers of Defense. The harmonious alternation between the Jaber and Salem branches of the ruling family stood until 2006, when Saad Al-Abdullah ruled Kuwait for nine days and was voted out of office by the Parliament due to health concerns. This led to the coronation of Sabah Al-Ahmed and narrowed the rule further within the Jaber branch. Sabah Al-Ahmed was considered the last strong ruler in the House of Sabah. He appointed his half-brother Nawaf al-Ahmed as his crown Prince. Following the death of Sabah al-Ahmed in 2020, according to Kuwaiti law, the new emir, Nawaf Al-Ahmed, had a one-year period to select his crown prince. There were several promising candidates for the crown prince, including former Prime Minister Nasser Al-Mohammed al Sabah (son of Emir Sabah Al-Ahmed), Prime Minister Jaber Al-Mubarak Al-Sabah, or Deputy Prime Minister Nasser Sabah Al-Ahmad Al-Sabah.

The election of then-Prime Minister Jaber Al-Mubarak Al-Sabah presented a unique opportunity, as it would have been the first time in 100 years that a descendant from the Al-Hamad branch had a chance to become the next Emir of Kuwait. However, Emir Nawaf Al-Ahmed acted quickly, selecting his half-brother, Mishal Al-Ahmed, at a special session of the Kuwait National Assembly after just eight days in office—marking a record-short selection period. Upon assuming the role of crown prince in 2020, Mishal Al-Ahmed, who had spent most of his career in the Kuwait’s security and intelligence apparatus, became the world’s oldest crown prince at the age of 80.

What occurred right before Emir Sabah Al-Ahmed’s death that diminished Prime Minister Jaber Al-Mubarak Al-Sabah’s prospects of becoming the next crown prince? The answer can be summed up in two words: JHO LOW.

Target “Sheikh Jaber Al-Mubarak Al-Sabah” : How Jho-Low’s CCCC-Al Asbar scandal fueled the Kuwaiti Purge

What actions did Jho Low take that undermined Sheikh Jaber’s Al-Mubarak chances of becoming the new crown prince of Kuwait? In 2015, several news sources had already reported connections between the 1MDB Fund and business dealings involving Jho Low. In September of that year, Swiss authorities announced the freezing of bank accounts linked to the fund.[12]. The same month, the U.S. Department of Justice confirmed that it had opened a corruption investigation into Jho Low’s business dealings [13]. Despite these developments, Jho Low made several public appearances at high-profile cancer galas towards the end of 2015. This “Mastermind,” we have been repeatedly told, seemingly remained unaffected by the simultaneous criminal probes unfolding in various countries.

The cover story is the following. Around that time the 1MDB fund was late on a payment for a loan given by International Petroleum Investment Company (IPIC), an Emirati institution based in Abu Dhabi. The IPIC loan was part of a financial support agreement signed between 1MDB and IPIC in 2015, in which IPIC agreed to provide $1 billion to help 1MDB settle its debts. Jho Low sought to use Kuwait as a channel to move and hide funds linked to 1MDB.

Syrian-French businessman Bachar Kiwan played a crucial role in facilitating the relationship between Jho Low and Sheikh Sabah Jaber Al-Mubarak. This connection allowed Jho Low to use Kuwait as a hub for laundering money from the 1MDB scandal through various Kuwaiti and offshore companies. Jho Low and Bachar Kiwan were connected through their business dealings and shared interest in exploiting political and financial networks in Kuwait. Bachar Kiwan is also a convicted international felon with strong ties to the Kuwaiti elite. He co-founded Al Waseet International, a media and business group in the Middle East. Kiwan had longstanding relationships with prominent figures in Kuwait, including Sheikh Sabah Jaber Al-Mubarak Al-Sabah, the son of a former Kuwaiti Prime Minister.

Jho Low and Sheikh Sabah collaborated to funnel money through Kuwaiti companies as well as offshore entities. These channels were used to launder money from the 1MDB scandal. The funds were transferred to various accounts, including those held at the Industrial and Commercial Bank of China (ICBC) in Kuwait. These included investments by Chinese state companies under the guise of legitimate infrastructure projects. The money was mostly intended to repay 1MDB’s debts while enriching the involved parties through commissions on inflated contracts.

In March 2023, the alleged mastermind behind Malaysia’s 1MDB scandal was sentenced in absentia to 10 years of hard labor in Kuwait. This sentence was for laundering over $1 billion linked to the $4.5 billion that was stolen from the Malaysian sovereign wealth fund known as 1MDB. Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah, and a third man who went to the prestigious British Wharton Business School with Jho Low, Hamad Al Wazan, were also sentenced to 10 years each in jail. The Kuwaiti Public Prosecutor had revived in September 2022 a previous 1MDB case opened years earlier, frustrated after failing to receive information from foreign parties for two years. According to the sentence, the $1 billion laundered through Kuwait was paid in Chinese currency, so it stayed out of the US banking system — “and out of reach of the US DOJ and its investigators”. Almost US$1 billion was deposited into the account of the son of Kuwait’s former prime minister Sheikh Jaber Al-Mubarak. The court also ordered them to pay a fee of US$500 million and refund US$1 billion (RM4.42 billion). The Public Prosecutor asserted that the men were an “organized criminal group” that laundered money in Chinese currency while being aware that the funds were obtained through stealing, crime, and transactions in Malaysian state funds.

Chinese state companies, with the assistance of the Chinese government, agreed to forward funds allegedly for the East Coast Rail Link (ECRL). Najib unexpectedly had increased the budget for this project by 100%. Later, it was revealed that a significant portion of this money was funneled to Kuwait from the Chinese construction company CCCC. This amount was transferred into an account owned by Sheikh Sabah Jaber Al-Mubarak at ICBC Bank, disguised as payment for a “bitumen shipment.” The funds were then redirected back to Malaysia through a Seychelles company, which was fronted by his lawyer, Saud Abdelmohsan. This was allegedly intended to purchase land owned by 1MDB, but the title was never transferred. The cash was then promptly sent by 1MDB to Abu Dhabi to pay off its debts, allowing the corrupt prime minister to maintain the appearance that the funds had not been misappropriated. In 2016, the royal family of Abu Dhabi, which had also received substantial kickbacks from the 1MDB heist, agreed to temporarily cover the repayments. However, they later requested the return of the billion dollars, leading to an international lawsuit in the UK.

According to the prosecution, Sheikh Sabah Jaber claimed in his defense that the funds were acquired from a Hong Kong-based business as a legitimate commission for advisory work completed in 2017 related to China’s Maritime New Silk Road project. Two other individuals were also sentenced: French-Syrian citizen Bachar Kiwan, who currently resides in Paris and received a ten-year sentence, and Kuwaiti lawyer Saud Abdelmohsan, who was sentenced to seven years.

Cracking the case: Sarawak Report and Bachar Kiwan

Curiously, the individual who first alerted the Kuwaiti authorities and the Malaysian public to Jho Low’s dealings in Kuwait cash was again Clare Rewcastle Brown. What the public does not know is that Clare Rewcastle Brown is a British intelligence operative who manages a fake independent investigative journalism site, the Sarawak Report. This website, which has been operating from London since 2010, claims to focus on environmental and corruption issues in Malaysia, but it is a poor and obvious cover for the British Intelligence Services.

In fact, it was again another angry and disappointed “businessman”, Bichar Kiwan, who played a critical role in exposing how money from the 1MDB fund was laundered through Kuwait. This exactly mimics the role played by another supposedly “angry” and “resented” ex-businessman, Xavier Justo, in the expose of PetroSaudi dealings by the Sarawak Report. The Sarawak Report asserts that it broke the case thanks to whistleblower Bichar Kiwan, who faced harassment after his relationship with Sheikh Sabah Jaber Al-Mubarak soured.

The “Military Fund Case”, the US DOJ, and the Kuwaiti Purge.

In 2019, Sheikh Nasser Sabah Al-Ahmad Al-Sabah, who succeeded Sheikh Khaled Al-Jarrah Al-Sabah as Defense Minister, initiated investigations into the misappropriation of military budget funds that occurred between 2001 and 2016 under previous Ministers of Defense. This included former Prime Minister Sheikh Jaber Al-Mubarak Al-Sabah and his associate, Sheikh Khaled Al-Jarrah Al-Sabah, from the Al-Jarrah branch of the Royal Family. The investigations uncovered evidence suggesting that approximately $790 million had been stolen or misused. These revelations led to a significant political crisis in Kuwait, ultimately resulting in the collapse of the government. In November 2019, following public outcry and mounting pressure from the ongoing investigations, Sheikh Jaber Al-Mubarak Al-Sabah resigned as Prime Minister. Several high-profile figures, including former ministers, were arrested or investigated in connection with the case [17-18].

Interestingly, the U.S. Department of Justice played a role in the downfall of the Kuwaiti government, ultimately leading to the removal of the Al-Mubarak and Al-Jarrah branches of the Kuwaiti royal family. When Sheikh Khaled Al-Jarrah Al-Sabah filed a lawsuit against a real estate agent in California over the purchase of luxury properties in Beverly Hills, U.S. investigators uncovered that over $160 million used to acquire these assets had originated from London-based accounts linked to Kuwait’s Military Aid Fund.

Sheikh Khaled Al-Jarrah Al-Sabah, the former Defense and Interior Minister of Kuwait, was sentenced for his involvement in a corruption case. He was found guilty of mismanaging and embezzling military funds. In November 2023, Kuwait’s highest court sentenced him to seven years in prison with hard labor.Sheikh Jaber Al-Mubarak Al-Sabah, the former Prime Minister of Kuwait, did not receive a prison sentence but was ordered by the Kuwaiti court to return the mismanaged funds [19]. Additionally, on April 13, 2021, a Kuwaiti court ordered his pre-trial detention on graft charges, making him the first former Kuwaiti prime minister to face such detention. He was released on bail at the end of 2021 but sadly passed away in 2024 at the age of 82 [20].

SUMMARY

This article delves into the clandestine operations orchestrated by the intelligence agencies from the UK, China, the US, Kuwait, and Saudi Arabia, focusing on their concerted efforts to manipulate the delicate royal succession lines in both Kuwait and Saudi Arabia. Through a series of covert maneuvers, these nations aimed to pave the way for their geopolitical interests. The intelligence services executed a sophisticated plan involving the illegal entrapment of several key figures who were potential candidates for the position of crown prince in both nations. This intricate strategy involved orchestrating scenarios designed to compromise these individuals. As a result, potential candidates found themselves ensnared in scandals, leading to widespread purges and reshuffling within the royal ranks. The repercussions of these actions were profound, triggering not only political upheaval but also shifting power dynamics in the region.

References

[2] Goldman Sach sues Malaysia over 1MDB settlement (Reuters, 10/11/2023)

[3] U.S. Seeks to Recover $1 Billion in Largest Kleptocracy Case to Date ( 07/20/2016 FBI News)

[4] Swiss Court convicts executives over $1.8 billion 1MDB scandal (Reuters, 08/24/2024)

[5] Malaysia halves ex-PM Najib Razak’s jail term over 1MDB scandal (BBC, 02/02/2024)

[6] US to recover Monet, Warhol, from fugitive financier Jho Low over 1MDB scandal (6/26/2024)

[7] Singapore refuses to give up pursuit of Jho Low, unfazed by US deal (SCMP 07/17/2014)

[8] The Carlyle Mubadala Alliance: A new Blueprint for Oil & Gas Bribery (KickBack News 10/07/2021)

[9] The Reserves Fraud Case at the center of the 1MDB operation ( Kickback News 07/21/2021)

[10] Anatomy of a kickback: PwC complicity in the 1MDB operation ( KickBack News 07/21/2021)

[12 ] Swiss freeze millions amid investigations of Malaysian fund (CNBC Sept 2nd 2015)

[18] Case filed in USA against Sheikh Khaled Al-Jarrah (Arab Times Online, July 30th 2022)

[19] In historic first, Kuwait orders detention of ex-PM. (AmWaj.Media, April 14th 2021)

[20] HH Sheikh Jaber Al-Mubarak Al-Sabah passes away. (Arab Times Online, Sept 14th 2024)

Categories: State & Corporate Crime